- How to buy a car if you fall into that bad or fair credit

- If you have less than a 670 FICO score this video is definitely for you.

- If you’ve never bought a car on credit before

So if any of these apply to you, this post is definitely for you! By you reading this entire article it’s going to ensure that you get the best interest rate the best vehicle that meets all your wants and needs and the dealership will not be able to scam you!

There’s a lot of bad information on the internet when it comes to FICO scores and there couldn’t be one company that gives you the worst information and that’s CREDIT KARMA!’

Credit Karma is not the place to go to to get your FICO score!

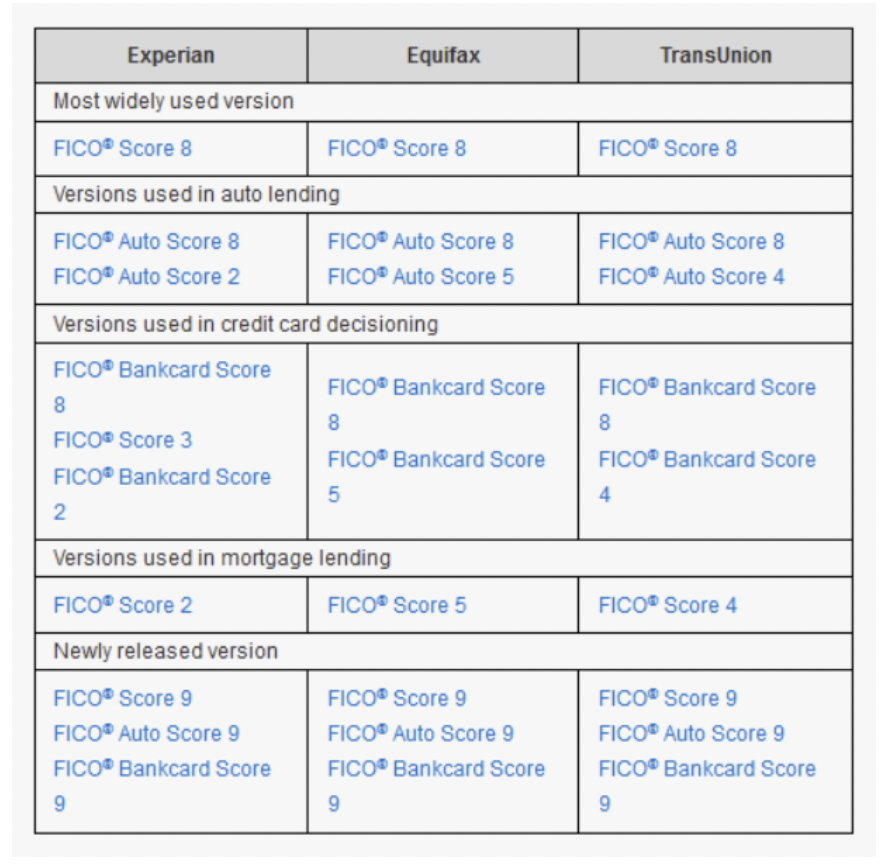

FICO score is made by one person and that’s fair Isaac’s company that’s why it’s called FICO! There are a lot of versions of FICO and the versions of these vary for Banks, Auto Lenders, Mortgage Lenders, and so on and so forth!

Typically speaking when it comes to auto we’re using the FICO score 8 version and then to throw a little bit more into it we’re using what’s called auto enhanced yes they’re giving you kind of like grading on the curve back in school they’re giving you a curved score based off of your previous automotive history.

Typically speaking when it comes to auto we’re using the FICO score 8 version and then to throw a little bit more into it we’re using what’s called auto enhanced yes they’re giving you kind of like grading on the curve back in school they’re giving you a curved score based off of your previous automotive history.

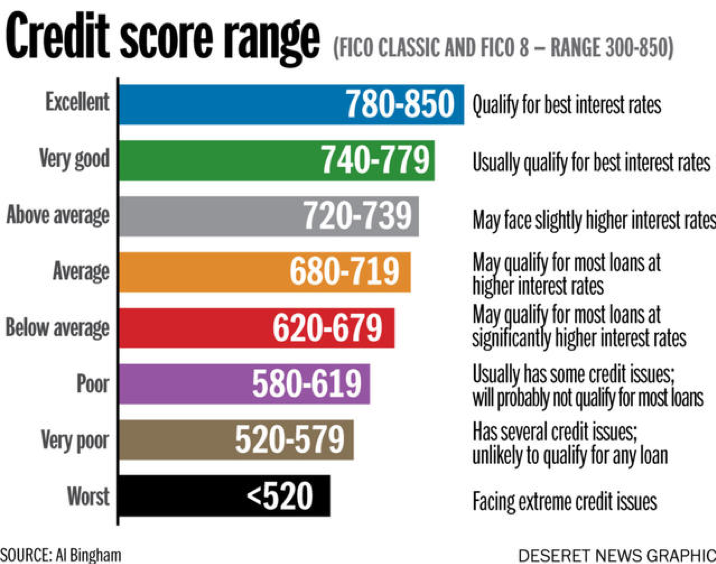

Your auto-enhanced FICO score can start all the way up to 900 and goes all the way down to 250 you’re not gonna find that much on the internet because you’re gonna find stuff like this on the internet that is giving you bad information!

It is charts like these that are not accurate when getting approved for a Car Loan!

1. Come in with an Open Mind

Now we have to do our homework before we go to the dealership but once you get to the dealership you’ve got to have an open mind. You’ve got to remember the three most important things that we’re going to do with our next car purchase is make sure that:

- We get good reliable and dependable transportation

– we get something that is affordable in our monthly budget and– most importantly get a vehicle that’s gonna lead us to a better credit score so that way when it comes time for the next car loan that we don’t have to worry about this article right here.

2. You’ve Got to Have Equity

Equity is so important in a car dealership and if you recently watched this video you’re gonna see that I try to get you and keep you away from a buy here pay here situation.

Having equity makes banks blind to your credit score they like to see that you have some interest and some involvement in the auto loan they know and understand that $500/$1000 down is a “down payment” when you do $2,000, $3,000, $4,000 plus down, now that becomes an investment in the bank’s mind.

They know based on their recovery rates– that if you have more money down the less likely that they’re going to have when it comes to a repossession.

Physical Cash Down & Trade Equity

Money down can come in a couple of different ways the most common ways is actual physical cash down and secondly trade equity now I’m going to tell you something on trade equity that probably nobody else out there is telling you and I’ve got a bank on my 21 plus years of selling cars on the front lines at a BIG Chevy Dealership here in Louisville, Kentucky.

Most times that you have a trade and you owe money on that car you have no positive equity you have negative equity so if you have negative equity or you owe more than what your car is worth there’s most likely that you got to have 10 to 20 to 30 percent down plus the negative equity to get financed if you want to find out how much negative equity you have

You can go to you can use the Value Your Trade Tool and it’s too pretty much tell you exactly what the Actual Cash Value (ACV) is on your vehicle and what dealers will offer you

The best equity to have is 20 and 30 percent down sometimes you can get by with just 10 percent and every bank varies sometimes they go off of nada trade-ins sometimes they go off of nada retail but you need to have at least 20 down to get favorable financing

3. Have all your Documents Ready

A lot of times banks will tell dealerships that PROVE IT that means we need to prove income, where you live, your insurance, and the vast other documents that they want us to get for this auto loan.

Documents you need to have ready:

- Check Stubs

- W-2s

- 1099s

- Bank Statements

Make sure you have access to all those when you go to the dealership or better yet print them off HERE you’ll be able to see this list of all the documents that you need when you go to the dealership to have ready for you print it off or be able to download it right there at the Dealership!

4. Don’t Shop Your Credit Round or Go Dealer to Dealer!

There’s sometimes almost no advantage to you to do this with the exception of getting a lot of inquiries on your credit report. inquiries don’t hurt your credit score much or at all but really there’s no reason to waste all of your time because there are so many variables when it comes to getting your car loan approved with less than a 670 credit score.

I’m not saying that you can’t let the dealership submit your credit information to several banks so that way you get the best terms I’m just saying that there’s really no advantage for you to go dealer to dealer and let them run your credit over and over and over again which leads me into the next tip!

This is very important for you in order to get a good deal on your next car with less than a 670 credit score and it goes back to before the first tip!

5. Contact the Dealership

You’ve got to do the due diligence you’ve got to do your homework before you contact a dealership you need to contact a dealership that has either me there or someone who’s dedicated in special finance a lot of dealerships have dealerships that have special finance managers maybe salespeople who deal with a lot of subprime or special finance customers, those are the perfect people to work with at the dealership definitely walk-in or call and say hey do you guys have a special finance manager. Everybody there is going to know what you’re asking about and referring to so it should be a really quick answer and most importantly if the dealership does not have their pricing on their website do not use them do not use them

I promise you that is worse than a buy here pay here to place you might as well go to buy your pay here place if you go to a dealership that has no pricing on their website those are the biggest scam artists in the industry so to recap on number five because I want to be really clear to make sure that you get the best experience and the best car deal that you possibly can!

Use me if you can come to the Mike’s Car Store or go to a dealership that has a special finance manager or has someone who dedicates themselves to special finance! Now a lot of times this is going to be a franchise dealer Chevy, Ford. Toyota, Honda! Those are the best dealerships out there to get you approved if you have less than a 670 credit score!

Extra Tips from Chevy Dude

When you go into the dealership make sure your Driver’s License has your correct name/address on it and make sure your Paycheck Stubs have your correct address on them and make sure everything you have has up-to-date information on it!

The worst thing that can happen and the deal will get kicked back from the bank after you leave and it’s going to create an amazing and negative response from the bank is you having the wrong information on driver’s licenses id cards, insurance, etc., and most importantly if you do have to log into or need bank statements to make sure you understand how to log into these places your insurance company bank statement so on and so forth!

Keep the names of six friends that are not in the same household!

Lastly, make sure that you have six names addresses phone numbers of all of your friends that are not at the same household because sometimes the banks do ask for references that are not people they’re really going to call what they usually use it for is at the end if you decide not to pay they call up and say “have you seen XYZ, I haven’t got I was trying to get a hold of him, will you have him call me.”, that’s how they use that!

The most important thing that you can do to help yourself on the next car deal is to watch the VIDEO FROM THIS ARTICLE HERE.